vermont department of taxes forms

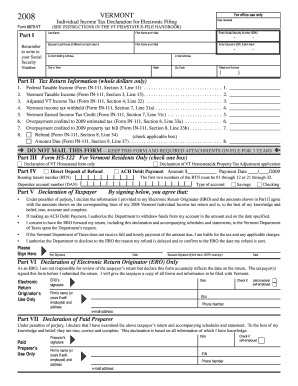

Generally the Department processes e-filed returns in about 6-8 weeks while paper returns typically take about 8-12 weeks. Vermont School District Codes.

Veterans Owed Refunds For Over Payments Attributable To Disability Severance Payments Should File Amended Returns To Claim Tax Refunds Va News

HS-122W Vermont Homestead Declaration andor Property Tax Credit Withdrawal.

. To 430 pm Monday through Friday. Employers must retain Form HC-1 for their records for three years. IN-111 Vermont Income Tax Return.

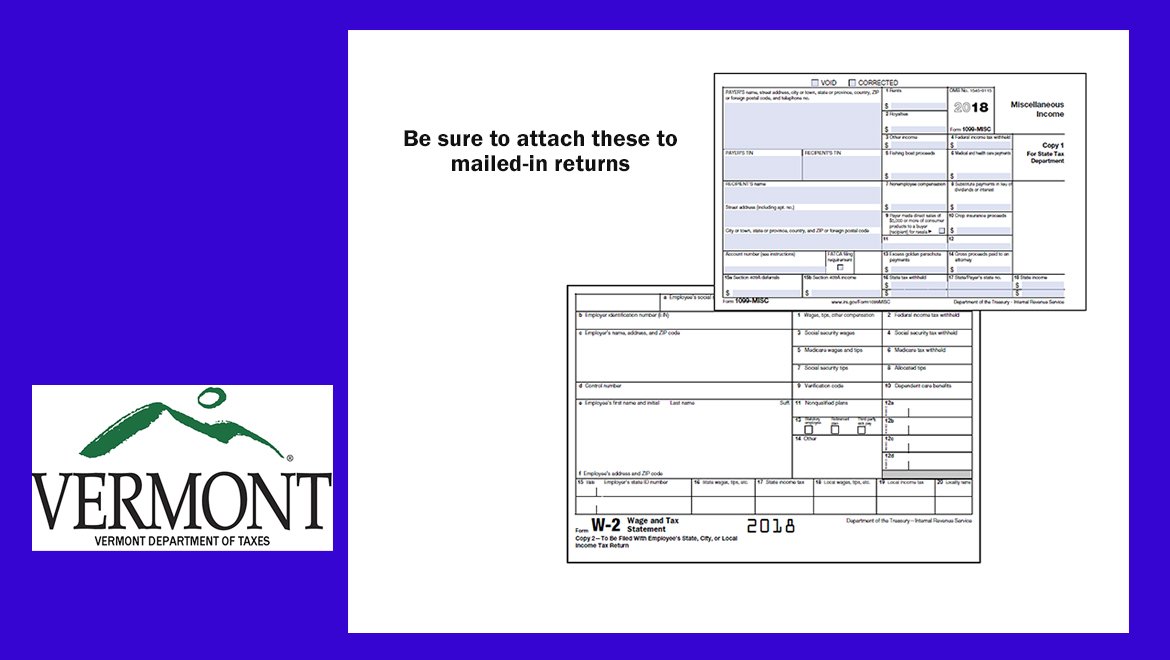

Vermont Homestead Declaration AND Property Tax Credit Claim. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games. You submit 25 or more W-2 andor 1099 forms with Form WHT-434 Annual Withholding Reconciliation or.

Be sure to enter the Plate number that you are transferring. 2022 Property Tax Credit Calculator. 2021 Vermont Income Tax Return Booklet.

2022 Property Tax Credit Calculator. PA-1 Special Power of Attorney. B-2 Notice of Change.

All Forms and Instructions. This booklet includes forms and instructions for. Domicile Statement Domicile Statement.

IN-111 Vermont Income Tax Return. All Forms and Instructions. You must file and pay electronically if.

HS-122W Vermont Homestead Declaration andor Property Tax Credit. To see when your local office is open for in-person services click here. PA-1 Special Power of Attorney.

The Vermont Department of Taxes determines the filing frequency for each taxpayer. Vermont Department of Taxes Issues Refunds to Unemployment Benefit Recipients. Most forms can be filled in electronically using Adobe Reader.

IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI-144. 2021 Vermont Income Tax Return Booklet. This booklet includes forms and instructions for.

You may submit all forms schedules and payments by. IN-111 Vermont Income Tax Return. All Forms and Instructions.

Accepting an Exemption Certificate in Good Faith The buyer must present to the seller an accurate and properly executed exemption certificate for the exempted sale. Learn about the regulations for paying taxes and titling motor vehicles. Form HC-1 is not required to be submitted to the Department.

The employer will use three forms. W-4VT Employees Withholding Allowance Certificate. For Sales and Use Meals and Rooms or Withholding.

IN-111 Vermont Income Tax Return. HS-122W Vermont Homestead Declaration andor Property Tax Credit. ACH Credit is an easy and convenient way to pay your Vermont taxes.

B-2 Notice of Change. PA-1 Special Power of Attorney. Vermont Taxes and the Manufacture and Sale of Alcoholic Beverages.

You must complete Section 7 of the Vermont Registration Application or incude your current Vermont Registration with the Transfer Section completed. Vermont Department of Taxes PO Box 1779 Montpelier VT 05601-1779. B-2 Notice of Change.

Annotated Vermont Fire Service Training Council Rules Guidelines on Gender Free Restrooms Business owner incentives for Sprinkler Systems Vermont Fire Loss Insurance Company Reporting forms Short Term Rental Checklist for short. PA-1 Special Power of Attorney. W-4VT Employees Withholding Allowance Certificate.

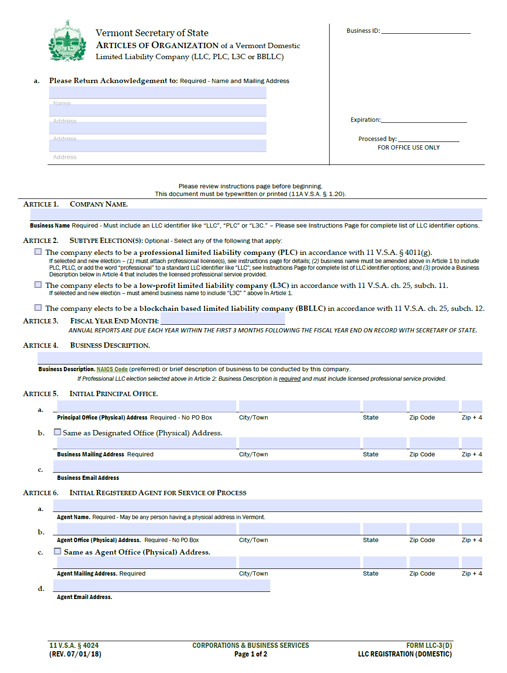

Pass-through entities including S-Corporations Partnerships and LLCs that elect to be taxed as Partnerships or S-Corps are subject to Vermonts business incomebusiness entity tax laws and provisions and file Form BI-471 Business Income Tax Return and related schedules. Vermont Homestead Declaration AND Property Tax Credit Claim. IN-111 Vermont Income Tax Return.

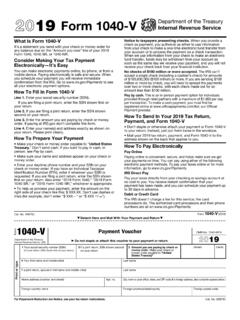

Mail your personal check cashiers check or money order payable to the Vermont Department of Taxes. Department of Taxes. B-2 Notice of Change.

W-4VT Employees Withholding Allowance Certificate. Vermont Department of Taxes PO Box 1779 Montpelier VT 05601-1779. The Vermont Department of Motor Vehicles Title VI Program Plan is prepared in accordance with 49 Code of Federal Regulation 21 and 49 Code of Federal Regulation Part 303.

Mail your personal check cashiers check or money order payable to the Vermont Department of Taxes. Complete the entire Vermont Motor Vehicle Registration Tax and Title Application form VD-119. Filing online through the Vermont Department of Taxes new online system myVTax has been mandated by the Commissioner of Taxes beginning with the tax year ending Dec.

Box 488 Montpelier 05601-0488 802 828-4000. Get the latest breaking news across the US. IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI-144.

Vermont Homestead Declaration AND Property Tax Credit Claim. Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001. PA-1 Special Power of Attorney.

Submit Your Payment by Mail. Vermont Department of Taxes 133 State Street 1st Floor Montpelier VT 05633-1401. B-2 Notice of Change.

What You Need to Know About the 2022 One-Time Tax Rebate In the fall eligible taxpayers will receive a one-time rebate of up to 250 for individuals and up to 500 for joint filers. Microsofts Activision Blizzard deal is key to the companys mobile gaming efforts. B-2 Notice of Change.

For information on Vermont Sales and Use Tax and exemptions see Vermont law at 32 VSA Chapter 233 and Vermont regulation at Reg. Personal check cashiers check or money order in person to. Review the ACH Credit instructions and ACH Credit Payments QuickStart Guide to get started.

Vermont School District Codes. Commercial Vehicle Enforcement DMV Investigations Highway Safety Driver Training Law Enforcement. The Department will begin processing returns in February.

2021 Income Tax Return Booklet. Most businesses operating in Vermont must first register with the Vermont Department of Taxes. If you are submitting any of the following paper forms by mail you may submit your payment with the paper forms below.

IN-111 Vermont Income Tax Return. Fact Sheets and Guides. Vermont School District Codes.

Fact Sheets and Guides. IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI-144. Fact Sheets and Guides.

To document additional taxes collected as a result of excess wear and tear andor excess mileage at. PA-1 Special Power of Attorney. Returns are held until the Department receives W-2 withholding reports from.

Vermont Department of Labor 5 Green Mountain Drive PO. Our office hours are 745 am. Sign Up for myVTax.

Form HC-1 -Health Care Fund Contributions Assessment pdf This form is a worksheet to help the employer determine if any assessment is due for the quarter. NTC-1256 Meals and Rooms Tax - Record of Payment. Department of Labor regional offices are currently operating with limited times for in-person services due to COVID-19 and staffing limitations.

This booklet includes forms and instructions for. W-4VT Employees Withholding Allowance Certificate.

Instructions Myvtax Vermont Gov You Also May E File This Vermont Department Of Taxes Pdf4pro

Vt State Tax Form Information Town Of Cave

Vermont Sales Tax Small Business Guide Truic

Federal Income Tax Deadline In 2022 Smartasset

But 451 Vt Form Fillable Fill Out And Sign Printable Pdf Template Signnow

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Vt Form 8879 Fill Out And Sign Printable Pdf Template Signnow

Vermont Department Of Taxes Forms Pdf Templates Download Fill And Print For Free Templateroller

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Form Co 411 Corporate Income Tax Return

Tangible Personal Property State Tangible Personal Property Taxes

Free Vermont Tax Power Of Attorney Form Pa 1 Pdf Eforms

The Irs S Crypto Question Might Change For Your 2022 Taxes Money

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

Publications Department Of Taxes

Tax Vermont Exempt Fill Out Sign Online Dochub

Vt Tax Dept Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Sun Community News Montpelier The Vermont Department Of Taxes Last Week Mailed 1099 G Forms To 21 000 Taxpayers That

Vt Dept Of Taxes On Twitter The Vermont Department Of Taxes Is No Longer Participating In The Combined Federal State Program For Submitting W 2 And 1099 Forms With The Irs You Must Now