maryland ev tax credit depleted

Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000. Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit.

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future.

. An official website of the state of maryland. The 7500 tax credit for buyers of electric vehicles is more than an expensive handout to rich tesla buyers. Effective July 1 2023 through June.

The Maryland Clean Cars Act of 2017 signed by Governor Larry Hogan extended the prior Electric Vehicle Tax Credit program through fiscal year 2020. The rebate is up to 700 for individuals. Marylands 3000 excise tax credit on.

Premium Federal Tax Software. In an attempt to create. WwwMVAmarylandgov Page 1 of 1 D-11-18.

Maryland Ev Tax Credit. Tax credits depend on the size of the vehicle and the capacity of its battery. Theres a standing 7500 federal tax.

All Extras are Included. Electric car buyers can receive a federal tax credit worth 2500 to 7500. 6601 Ritchie Highway NE Glen Burnie Maryland 21062 410-768-7000 1-800-950-1MVA Maryland Relay TTY 1-800-492-4575 Web Site.

All federal tax credit incentives have been depleted for tesla and. Ad Everything is included Premium features IRS e-file 1099-MISC and more. Funds Depleted for Maryland Electric Vehicle Excise Tax Credit for from.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000.

Cautionary Tale Maryland S Electric Vehicle Tax Credit Runs Out Of Money Skyline Newspaper

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price

Incentives Maryland Electric Vehicle Tax Credits And Rebates

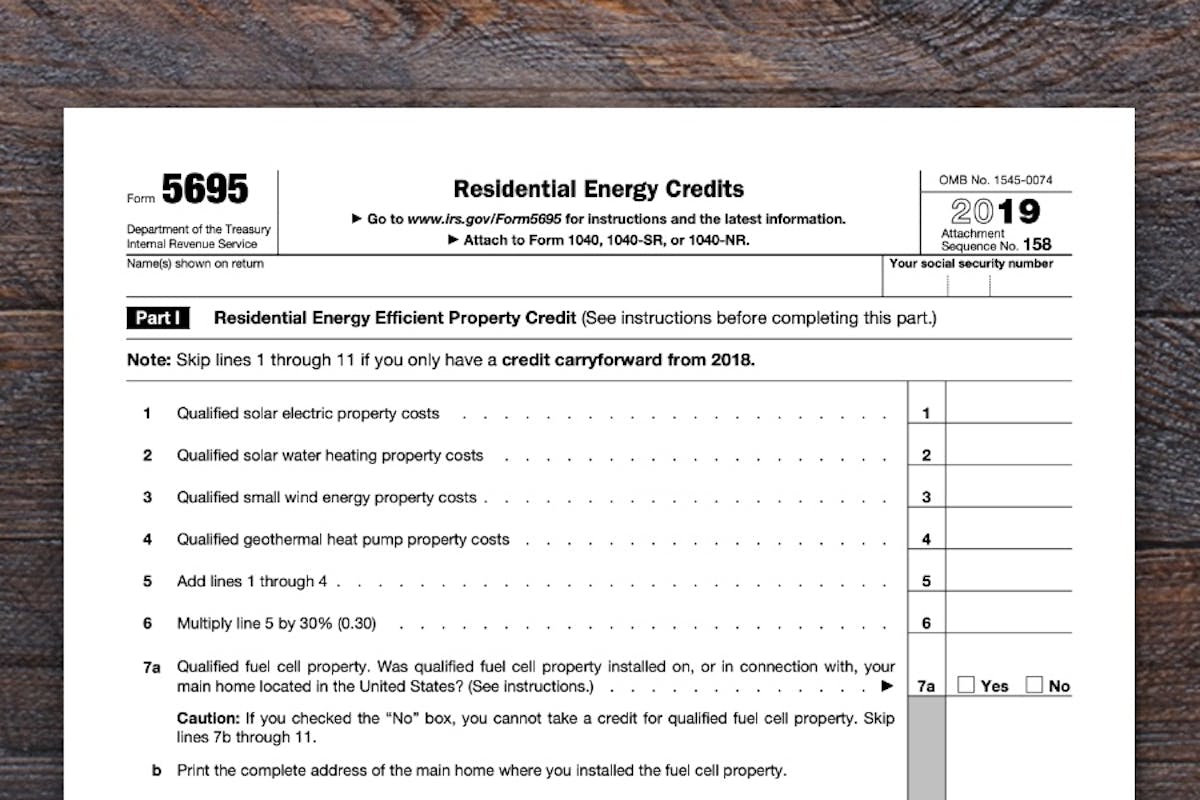

Everything You Need To Know About The Solar Tax Credit

![]()

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Do Electric Cars Really Save You Money

Electric Car Charging Station Installation In Maryland

Do Electric Cars Really Save You Money

What Is An Ev Tax Credit Who Qualifies And What S Next

Rebates And Tax Credits For Electric Vehicle Charging Stations

Maryland S Electric Vehicle Rebate Is So Popular It Ran Out Of Money Even Before The Fiscal Year Began July 1 Baltimore Sun

Tesla Increases Model Y Prices Again As New Incentives Are Coming Electrek

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland S Electric Vehicle Rebate Is So Popular It Ran Out Of Money Even Before The Fiscal Year Began July 1 Baltimore Sun

Funds Depleted For Maryland Plug In Vehicle Excise Tax Credit For Fiscal Year 2016 Pluginsites

Electric Vehicle Incentives Update

Electric Vehicle Supply Equipment Evse Rebate Program

Public Utilities And Transportation Electrification Iowa Law Review The University Of Iowa College Of Law

Funds Depleted For Maryland Plug In Vehicle Excise Tax Credit For Fiscal Year 2016 Pluginsites